Any deviation from the general tax regime laid down in the state laws which provides for a reduction in the tax burden or more favourable tax payment procedures for a taxpayer or a group of taxpayers may be regarded as a tax relief on the basis of the criterion that the taxpayer or a group thereof conforms to a characteristic specified in the tax law (amount of income, marital status, type of economic activity, region, etc.).

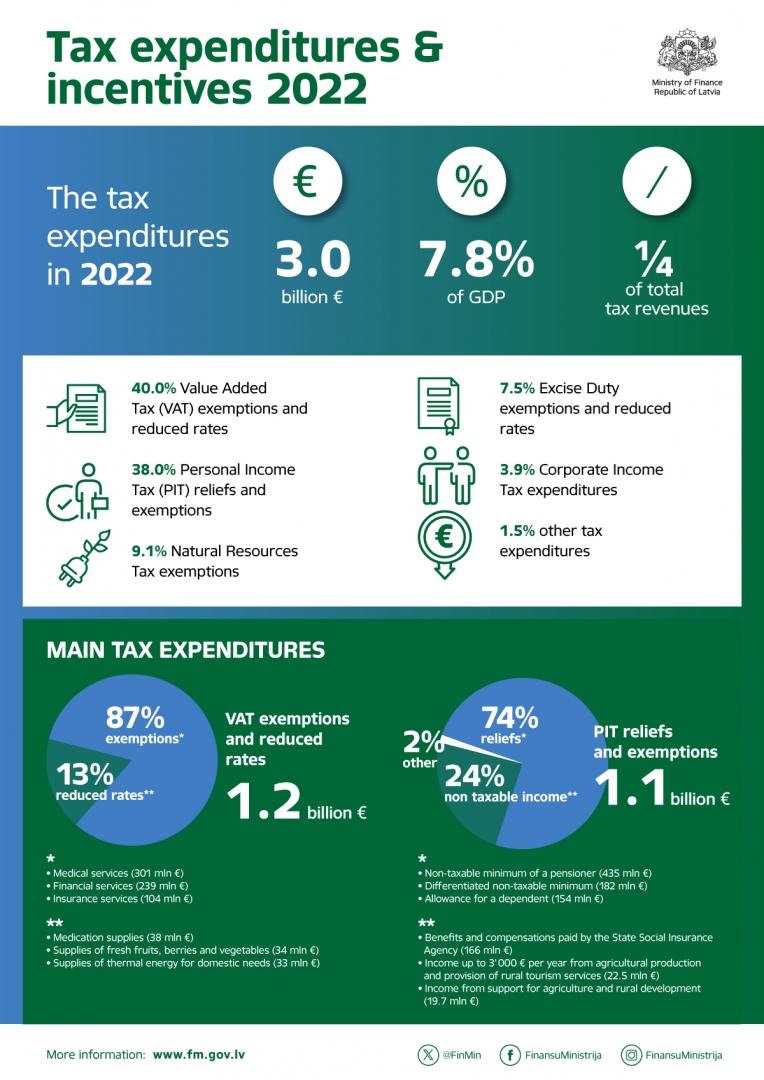

Approximately 319 different tax expenditures are currently applied in Latvia. According to the calculations of the Ministry of Finance tax expenditures in 2022 were around 3.0 billion euro, which is 7.8% of GDP and amounting for almost ¼ of the total tax revenues. The tax expenditures in 2022 compared to 2021, increased by 117.4 million euro, or by 4.1%.