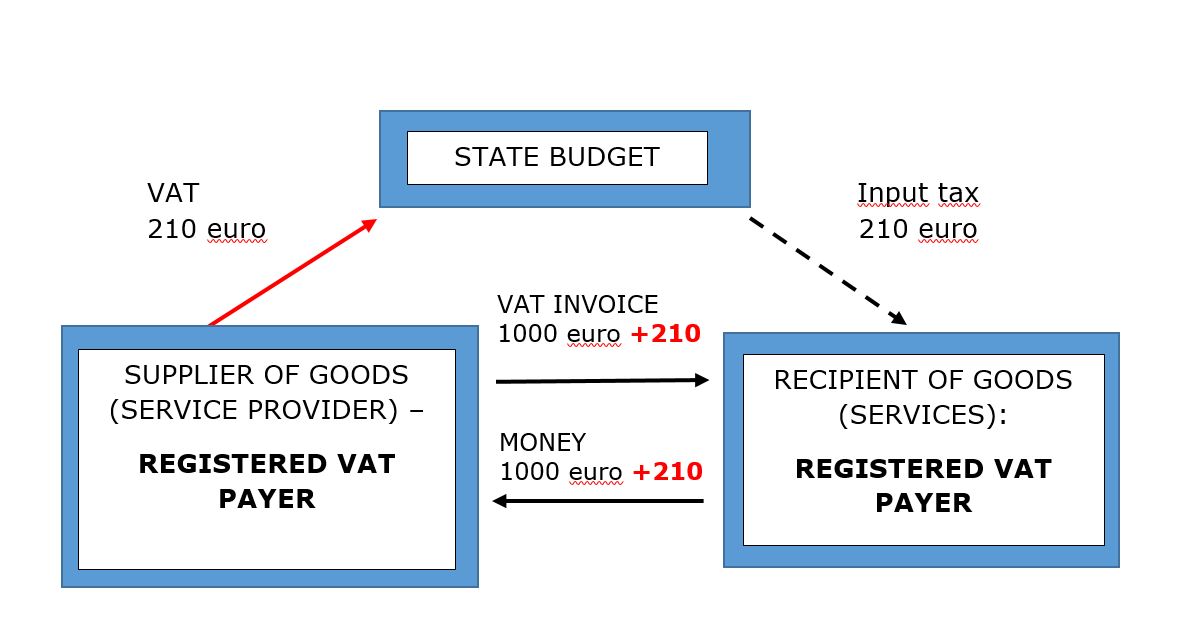

In the case of the general VAT payment procedure:

1. the supplier of goods (service provider) shall issue a VAT invoice to the recipient of goods or services where the following shall be indicated:

- the value of delivered goods (services provided) of EUR 1000;

- the VAT rate of 21% calculated VAT amount of EUR 210 (i.e., EUR 1000 x 21%);

- includes in its VAT return the transaction value of EUR 1000 and the calculated VAT amount of VAT EUR 210 as the amount of VAT payable to the State budget.

2. the recipient of goods (services):

- pays the invoiced remuneration and the VAT amount of EUR 1210 (i.e., EUR 1000 + EUR 210) to the supplier of goods (service provider);

- if the purchased goods (services received) are intended for the provision of transactions subject to VAT of the recipient of goods or services, the VAT amount indicated in the VAT invoice shall be included in his VAT return as deductible input tax of EUR 210.

Note. In the case of general VAT payment procedure, the recipient of goods (services) may not be a registered taxpayer, in which case the recipient of goods (services) does not have the right to deduct the input tax.