Any deviation from the general tax regime laid down in the state laws which provides for a reduction in the tax burden or more favourable tax payment procedures for a taxpayer or a group of taxpayers may be regarded as a tax relief on the basis of the criterion that the taxpayer or a group thereof conforms to a characteristic specified in the tax law (amount of income, marital status, type of economic activity, region, etc.).

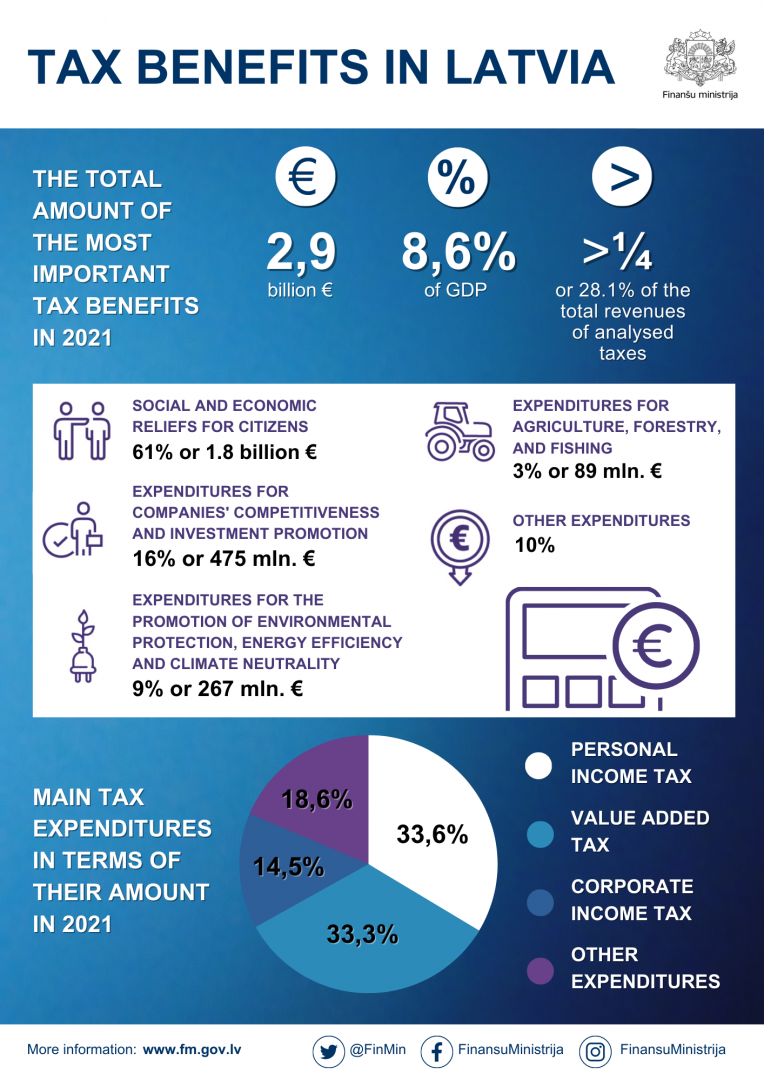

Approximately 319 different tax expenditures are currently applied in Latvia. According to the calculations of the Ministry of Finance in 2021, the total income foregone by the State as a result of the tax relief applied was approximately 2,9 billion euro, which is 8.6% of GDP and approximately 1/4 of the total revenue of the analyzed taxes. In 2021, compared to 2020, the total amount of tax expenditures has increased by 19.9%.