The term public-private partnership (PPP) refers to co-operation between the public and private sector established for a fixed-term and on certain conditions to meet public needs in performing construction works and providing services.

In Latvia, according to Clause 1(1) of the Law on Public-Private Partnership, the PPP refers to co-operation between the public and private sector simultaneously characterized by the following features:

- co-operation is between one or several public partners and one or several private partners involved in the public-private partnership procedure;

- co-operation is carried out in order to meet public needs in performing construction works or providing services;

- it is a long-term co-operation lasting up to 30 years but even longer in the cases, when it is necessary for the purpose of a contract and deliverables based on financial and economic calculations;

- a public and a private partner pool and use the resources available thereto (e.g. property, financial resources, knowledge and experience);

- a public partner and a private partner share the responsibility and risks.

PPP is not a new term, since certain forms of it can be found in ancient times. In the present world, the growing number of countries view PPP as an alternative to a traditional public investment model and a solution for providing successful public services, developing and maintaining infrastructure, which is indispensable for the whole society. PPP is widely used in Great Britain, Ireland, the Netherlands, France, the USA, Canada, Australia and a range of other countries.

In the practice of EU countries, common PPP contracts involve the design, construction, maintenance and management of roads and other objects of public infrastructure, provision of waste management and heat supply etc., moreover, as can be seen from the examples above the PPP is implemented in such sectors that require considerable investment and special technical and administrative knowledge. If these services have been traditionally provided and financed by the state or municipality, i.e. a public partner, then as a result of PPP the private capital is involved to provide these services, simultaneously sharing the risks, investments and benefits related to PPP implementation between a public partner and a private partner. The public partner can thus focus on the execution of the primary functions, i.e. planning and monitoring functions.

A common feature in any PPP is the realization of value for money – the acquisition of the financial usefulness of investments along with the hand-over of respective risks, promotion of innovations and efficient management of resources. Thus the determination of value for money is one of the major components in adopting the decision on PPP implementation. Such approach is used in all countries implementing a targeted policy.

Public-private partnership types and forms

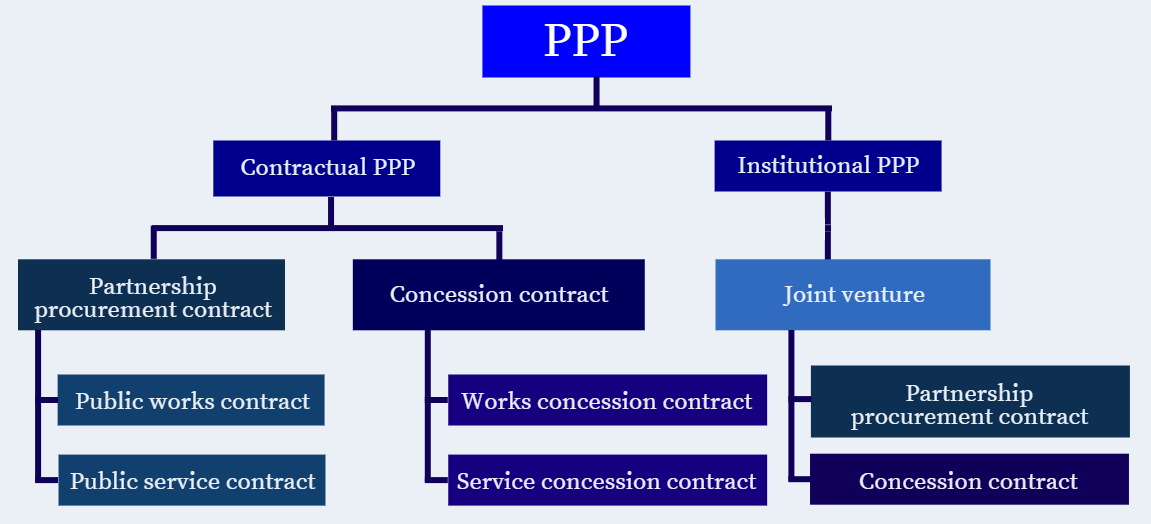

In Latvia as in any other EU Member State it is possible to implement both the contractual and the institutional PPP, in both cases concluding either a partnership procurement contract or a concession contract.

The public partner can thus choose and adapt the PPP implementation form as needed, for example, taking into account the specifics of a concrete object or service.

The PPP agreement is defined in terms of a procurement contract and a concession contract.

Partnership procurement contract – a civil contract entered into by a public partner and a private partner for the period of time that is longer than five years, but does not exceed 30 years and stipulates:

- public construction works case: execution of public construction works with the following private partner duty to carry out the management of a constructed building;

- public services case: the provision of public services and execution of related construction works not being a core element of the purpose of the contract.

Public partner makes payments on the basis of the quantity of service or availability of a construction.

At international level the partnership procurement contracts are often indicated by abbreviations on the basis of the list of activities of a private partner within the contract framework – design, construction, renovation, financing, management, administration, etc. Such abbreviations can also be used in Latvia, adjusting the form of a partnership procurement contract in the case of construction works or public services.

Concession contract – a civil contract entered into by a public partner and a private partner for the period of time up to 30 years and stipulates:

- works concession case: execution of a construction design and related works mentioned in the Law on Public Procurement, Annex 1 or just works mentioned in the Law on Public Procurement, Annex 1;

- service concession case: provision of services mentioned in the Law on Public Procurement, Annex 2. If a service concession contract does also include the execution of construction works mentioned in the Law on Public Procurement, Annex 1, not being its core element, such contract is considered as a public services contract.

It is important that, concluding a concession contract, a private partner acquires the rights to use the construction or services as a remuneration or its essential part, i.e. the right to receive fees from a construction or end-users of a service or the right to receive remuneration from a public partner the amount of which depends on the end-users’ demand for a construction or a service, or also to receive both the fees from a construction or service end-users and the mentioned remuneration from a public partner who also receives the exploitation risks or their essential part related to a construction or a service provision – economic risks, when the income of a private partner depends on a construction or the demand for this construction or service (demand risk) on the part of an end-user or on whether this construction or service is offered to the end-user in accordance with the demands laid down in the concluded concession contract (availability risk), or on both the demand risk and the availability risk.

! PPP contracts exceeding 30 years can be concluded if the contract objective and expected results require it and if it is based on financial and economic calculations.

Contractual PPP

Within the framework of a contractual PPP the cooperation between a public partner and a private partner is established in that the public partner concludes a contract with the private partner regarding the construction works and/or service provision.

Although a private partner can be almost any person or an association of persons that has participated in and won the PPP procedure and with whom the PPP contract is concluded, taking into account the reallocation of possible PPP amount and risks, usually in order to ensure a contractual PPP on the part of a private partner, an undertaking of interested parties (a constructor, a manager, a service provider, etc.) is established – a special purpose entity (in the EU member states also known as special purpose vehicle). A public partner can also intend the establishment of a special purpose entity in the PPP procedure documents, setting it as an obligation for the performance of the PPP contract.

The commercial law provides a procedure for establishment of a special purpose entity. The Law on Public-Private Partnership still sets some restrictions, for example, by providing for the funder interference rights in the establishment documents of the special purpose entity to change a participant or a member. The Law on Public-Private Partnership also provides for the procedure of changes in the PPP contract concerning the participants or members of the special purpose entity. In addition, for some other person to become either a participant or a member of the special purpose entity it is necessary to receive consent from each public partner representative, and the procedure for carrying it out has to be defined in the PPP contract.

Institutional PPP

The main difference between an institutional PPP and a contractual PPP is the fact that in the institutional partnership a public partner and a private partner join in a joint venture (a capital company) and the public partner concludes a PPP contract with it as with a private partner.

An institutional PPP can be chosen in a case if the public partner wishes to have a stronger control over the execution of the PPP contract and participate in the administration of the established capital company, since both a public partner and a private partner jointly participate in the administration of an established joint venture. PPP risks, income and losses usually are shared in proportion to the shares of a public partner and a private partner that they have in a joint venture.

The main benefits of a joint venture:

- a joint venture is a separate legal entity functioning on its own account and independently of its founders, namely, a joint venture signs up for commitments in its own name. Both a successful or unsuccessful outcome largely depends on the ability of a joint venture and its administration to implement the tasks entrusted to it;

- an establishment of a joint venture can contribute to the adoption in the public sector a successful practice of the private sector, administration and manufacturing methods as well as other knowledge;

- a public sector still retains the possibility to ensure its veto rights and control over deciding on some important issues in a joint venture.

A risk factor to the establishment of a joint venture are the difficulties to adopt a decision, since both sides represent different interests – the state and the municipality are interested in a common good procurement, while a private partner aims at a higher profit. The state and the municipality need to dissociate themselves from business activities as much as possible, since it would deform the market. Since in the case of a joint venture the state or a municipality is a co-owner of the undertaking, the public partner himself shall assume co-responsibility in the case if the service of the undertaking does not meet the quality criteria. This lessens the project implementation risks for a private partner, but increases the risks of a public partner.

When the PPP contract comes to an end, the activity of a joint venture is also ended.