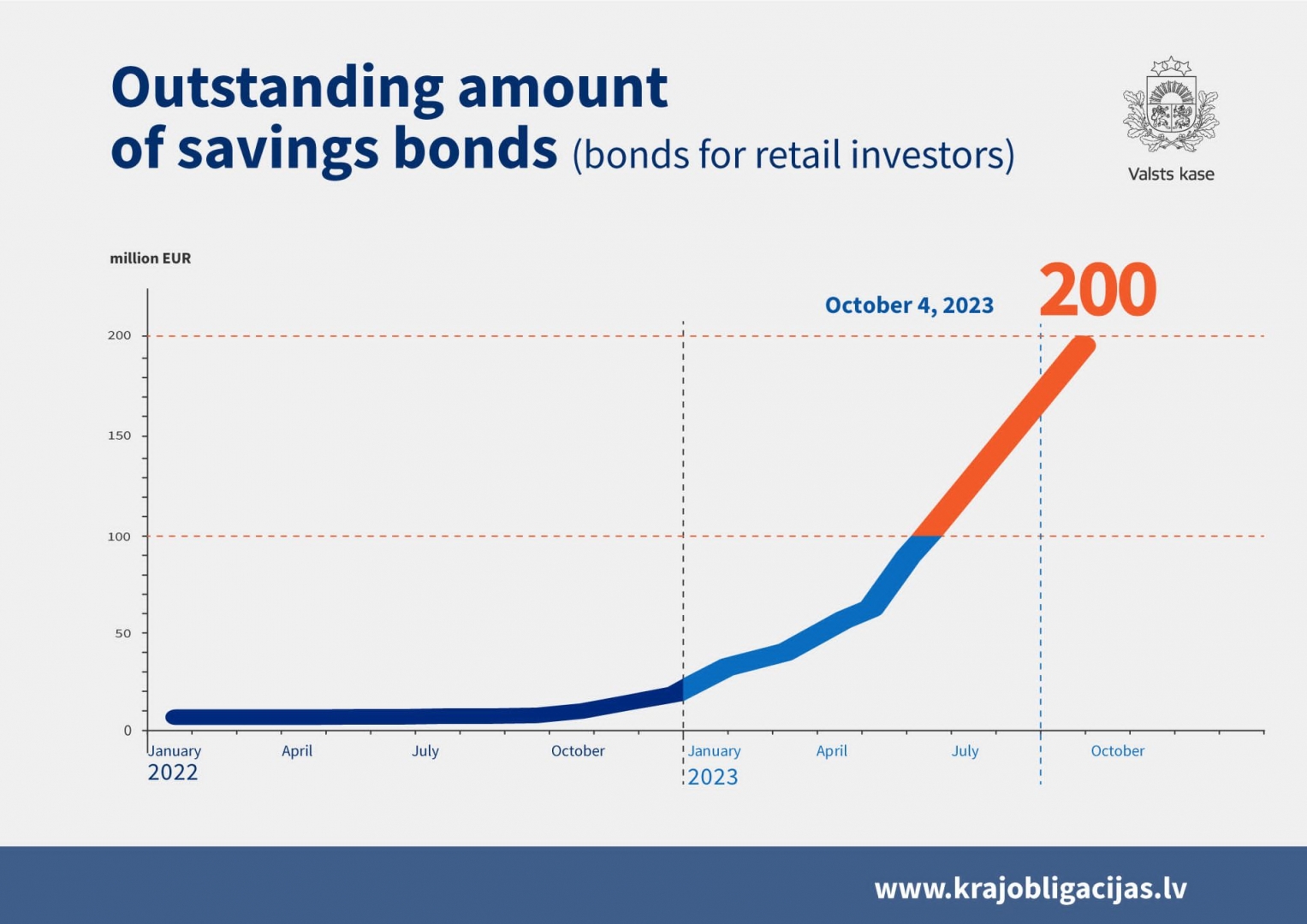

On Wednesday, 4 October, the volume of deposits of the population into savings bonds issued by the Treasury reached EUR 200 million, with the total number of investors exceeding 6 thousand.

Given the increased interest of the Latvian population in financially rewarding investments, as well as the growing financial literacy of investors, the popularity of savings bonds continues to grow rapidly. The volume of investments performed by the population into savings bonds has doubled since the beginning of June – residents have invested EUR 100 million into savings bonds over the period of the last four months alone.

Up to now, 12-month and 3-year savings bonds have been most popular among the population, but at the moment demand for longer-term savings bonds (especially 10-year bonds) is increasing, as they offer investors the possibility to receive non-taxable fixed income according to the current interest rates on financial markets. For example, it is currently possible to invest in 10-year savings bonds at an interest rate of 4.15%, which remains fixed up to the maturity of the savings bonds.

The current savings bond offering is available on the website www.krajobligacijas.lv and the acquisition of savings bonds can be performed at any time by selecting the preferred savings bonds maturity and paying for acquisition online. There are savings bonds with maturities of 1 year, 3 years, 5 years, 7 years and 10 years currently available in the public offering. The minimum amount of investment in savings bonds is only EUR 50 and there is no limit on the maximum amount.

Savings bonds represent a safe investment alternative in volatile financial market conditions, as they constitute an investment in State securities that are fully guaranteed by the Latvian State regardless of the investment amount, at the same time providing the opportunity to receive a non-taxable fixed-interest income every year up to the maturity of the savings bond. The Treasury has been issuing savings bonds on behalf of the Republic of Latvia since 2013.