On Tuesday, October 14, the government approved a draft law on the 2026 state budget and the medium-term budget framework for 2026–2028, which was prepared in accordance with European Union (EU) and national fiscal discipline rules. The consolidated state budget revenue for 2026 is planned to be EUR 16.1 billion, while expenditure is planned to be EUR 17.9 billion. The budget for 2026 has been developed with a view to ensuring a more secure future, providing for additional investments in national security, support for families with children and quality education, while maintaining the historically highest level of EU fund investments, as well as an increase in local government revenues of 151.4 million euros, strengthening the resilience of the state and society.

"This budget is a confirmation to society that security, care for families, and economic development are the state's highest priorities. Together with our partners, we have found a balance in next year's budget between responsible spending cuts and smart investments. The most important taxes for society will not be increased, but we will invest in security, support for families, and competitive education. Security is not just about purchasing equipment or technology, it is about ensuring that every child in Latvia has a good school and that parents have the support they need," says Prime Minister Evika Siliņa.

Compared to the 2025 budget, the increase in state budget revenue in 2026 exceeds the increase in expenditure. State budget revenue is expected to increase by €944.6 million, while expenditure is expected to increase by €804.3 million. The planned revenue in the basic budget is EUR 10.9 billion, while expenditure is EUR 13.2 billion. In the special budget, revenue is planned at EUR 5.5 billion, while expenditure is EUR 5.1 billion.

"In the 2026 budget for a more secure future, the government has solved the most difficult task – to provide the necessary funding to strengthen Latvia's defense capabilities. At the same time, we have managed to increase support for families and investment in education, as well as allocating more than €1 billion in EU funds for economic growth, including regional development, infrastructure, business competitiveness, and human capital. These are long-term investments that strengthen the security and stability of society and the state. It is important to note that we have achieved this by streamlining public administration expenditure by more than €800 million over a three-year period and without increasing basic taxes," emphasizes Finance Minister Arvils Ašeradens.

Key macroeconomic indicators and forecasts

The 2026 state budget is based on cautious macroeconomic forecasts developed in June this year. They predict moderate economic growth and a gradual decline in inflation in the medium term. The most significant contributions to economic growth this year are coming from the construction, manufacturing, and trade sectors. After several years of stagnation, corporate lending has also begun to grow strongly this year, with the portfolio of loans issued to companies in August growing by 16% compared to August 2024. Economic growth of 1.1% is forecast for this year, while next year's budget forecasts growth of 2.1% and up to 2.2% in subsequent years.

The inflation forecast for 2025 has been raised to 3.5%, mainly due to rising food prices and heating tariffs. In the coming years, inflation is expected to gradually decline to 2.3% in 2026 and 2.2% in subsequent years, which is in line with the price growth level of a converging economy.

The general government budget deficit is projected to be 2.9% of GDP in 2025, rising to 3.3% in 2026 and remaining at around 3.6% in the medium term. The increase in the deficit is due to increased funding for strengthening national defense and security. This spending is being carried out under the EU's fiscal flexibility mechanism – the national exception clause – which allows member states to temporarily exceed deficit and spending limits if the additional funds are directed specifically to defense. Latvia is using this opportunity responsibly, maintaining the sustainability of its fiscal policy and planning a gradual reduction of the deficit at the end of the exemption clause period.

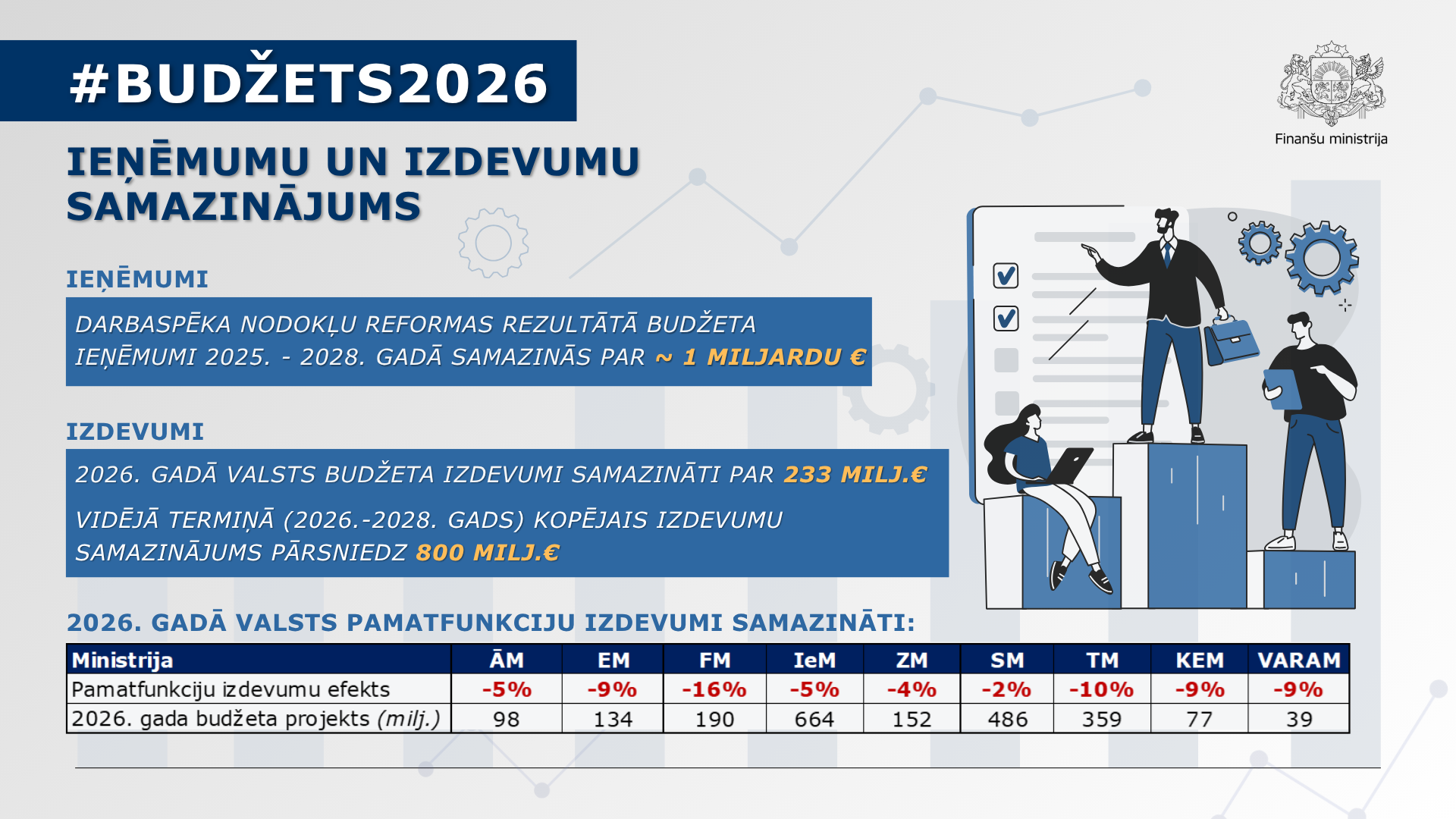

Reduction in state budget revenue and expenditure

In order to promote economic growth and increase residents' income, the government implemented a labor tax reform in 2025, reducing the tax burden on employers and employees. As a result of the reform, budget revenues will decrease by approximately €1 billion between 2025 and 2028.

Work on the 2026 state budget began with a reduction in state budget expenditures. The government's social and cooperation partners were actively involved in this process. The joint effort resulted in fiscal savings of €233 million for 2026, while in the medium term (2026–2028), total expenditure reductions will exceed EUR 800 million, confirming the government's consistent work on effective public resource management and strengthening financial sustainability.

Compared to the 2025 plan, in 2026, basic function expenditures in the state budget have been reduced, including in the Ministry of Finance (-16%), the Ministry of Justice (-10%), the Ministry of Climate and Energy (-9%), the Ministry of Economy (-9%), the Ministry of Foreign Affairs (-5%), and others.

These measures demonstrate the government's systematic and responsible approach to public finance management, moving towards sustainable expenditure reduction, resource optimization, and higher efficiency across the public sector, while ensuring the necessary financial resources for the government's priorities.

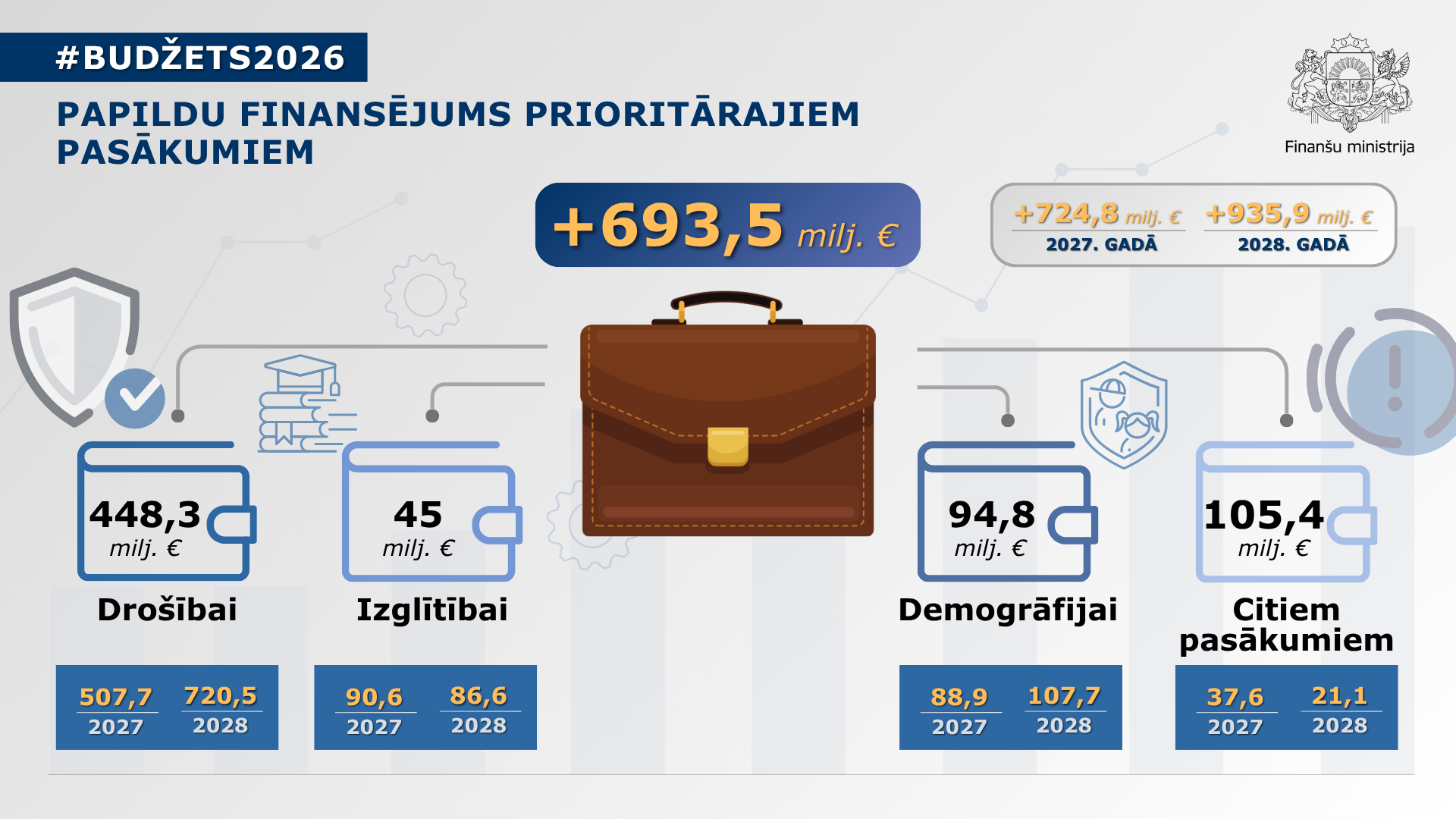

Additional funding for national priorities – national security, families with children, quality education

Additional funding for government priorities symbolizes Latvia's choice for a more secure future – strengthening defense, caring for families, and investing in knowledge. These are long-term investments that ensure the well-being of society today and the stability of the state in the future.

In total, an additional €693.5 million is earmarked for the government's priorities in 2026, €724.8 million in 2027, and €935.9 million in 2028. A significant part of this – EUR 448.3 million – is earmarked for strengthening national security, which will enable the improvement of the combat capabilities of the National Armed Forces, the development of military infrastructure and border protection systems, as well as the promotion of the growth of the local defense industry and the creation of new jobs. Total defense funding for next year will reach €2.2 billion. Latvia's defense funding, according to the NATO definition, will reach 4.9% of GDP in 2026, 5% of GDP in 2027, and 4.9% of GDP in 2028.

An additional €94.8 million has been allocated to support families with children and improve maternal and child healthcare, ensuring increased benefits, better access to services, and greater social security. Next year's funding for health will increase by €27.9 million compared to 2025, totaling €1.9 billion. In the field of education, €45 million is earmarked for the introduction of a new teacher remuneration model, "Programma skolā" (Programme at School), strengthening support staff and ensuring quality education throughout Latvia.

Additional investments are also planned for socially significant measures – expanding palliative care, improving the availability of social services and rehabilitation, as well as supporting farmers. These investments strengthen the overall well-being of society, improve the quality of life in the regions, and promote the sustainability of Latvia's economy. Overall, the government's decisions confirm its commitment to building a safe, socially responsible, and sustainable country, where people, their safety, health, and education are at the center of development.

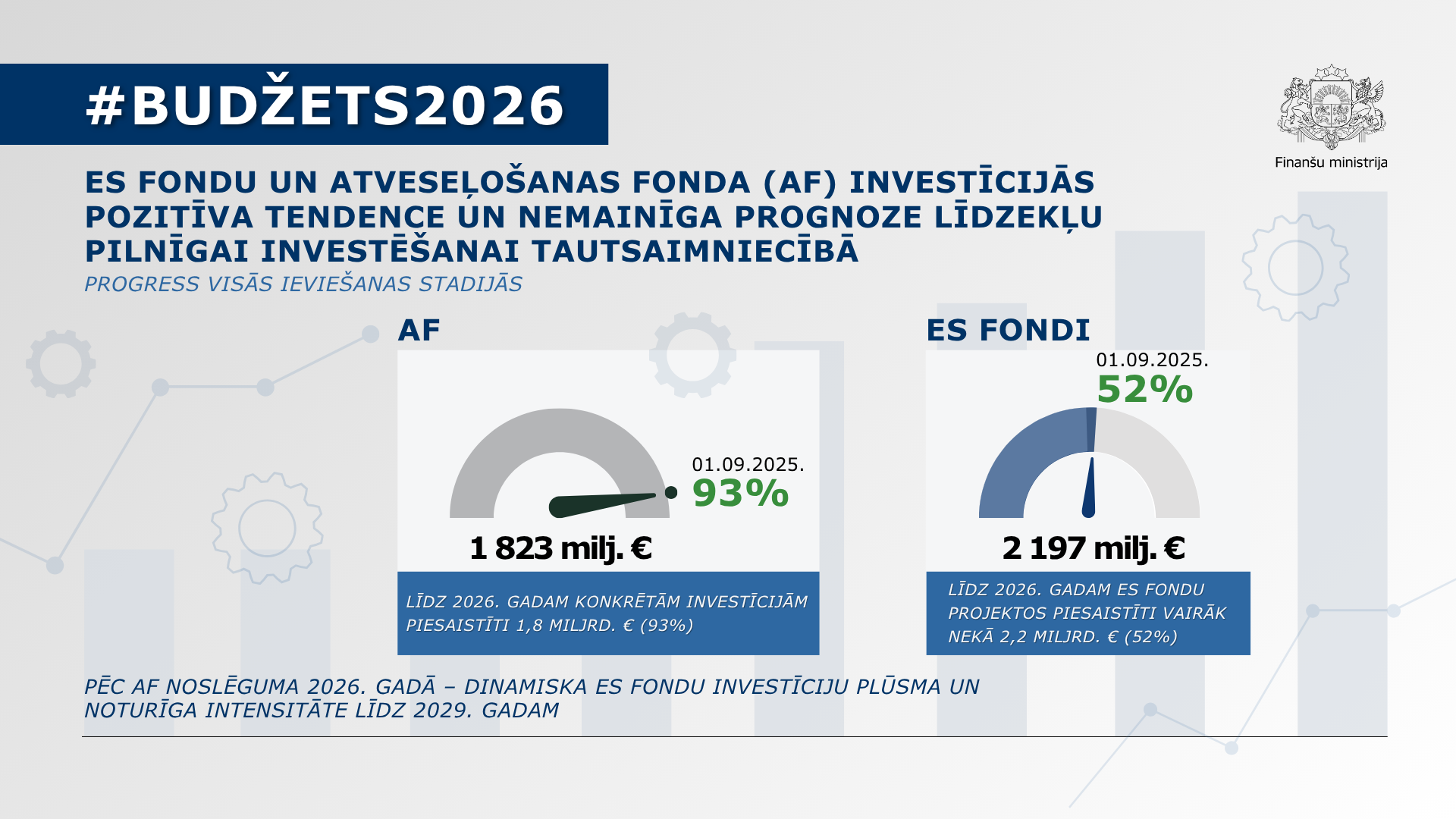

Investments in national economic growth

Investments from EU Cohesion Policy funds and the Recovery Fund (RF) will continue to be one of the most important drivers of Latvia's economic growth in 2026. Their volume will exceed one billion euros, remaining at a historically high level and significantly exceeding the figures for the previous planning period. These funds are being invested in strengthening security, regional development, infrastructure, promoting business competitiveness and human capital growth. By 2026, more than €2.2 billion has already been attracted to EU fund projects, and 93% of the total €1.97 billion in AF funding has been reserved for specific investments that are being implemented according to plan.

New investments implemented under the EC's ReArm Europe regulation are particularly significant. This allows 10% of EU funding to be redirected to security and defense projects, including the development of military and business mobility.

In addition to EU funds and AF funds, other foreign financial assistance programs are also continuing in Latvia. Within the framework of Swiss financial assistance, 49.8 million euros are planned until 2029, including a Swiss grant of EUR 42.4 million and co-financing from the state budget for four programs: improving children's cancer care, remediation of contaminated sites, applied research, and development of work-based learning. In turn, during the new EEA and Norway grant period until 2031, Latvia will have the opportunity to invest over EUR 100 million in targeted investments in three priority areas, together with co-financing from the state budget. EUR 43 million will be invested in strengthening local development and sustainability. This support is aimed at implementing the government's main priority, "National Security," by investing in civil protection infrastructure to create new shelters and adapt and equip existing facilities. The same applies to the purchase and installation of generators to ensure uninterrupted power supply for critical services in medical institutions and state social care institutions. EUR 27.5 million will be invested in green innovations, including support for entrepreneurship and the remediation of contaminated sites, while €15 million will be allocated to the correctional services program – the construction of a women's prison, the strengthening of correctional services, and rehabilitation services for children addicted to intoxicating substances. These foreign investments supplement EU funding, reducing the burden on the state budget and ensuring long-term investments in national security and public welfare.

The largest investments from the state budget, or €545.9 million, will be allocated to national defense, strengthening the combat capabilities of the National Armed Forces, developing military infrastructure and border defense systems, and promoting the growth of the local defense industry. Investments in the interior sector, amounting to EUR 67.9 million, are earmarked for the modernization of security service infrastructure, including the construction of new fire and rescue depots, the renewal of police transport, and the strengthening of civil protection.

Significant funding is also earmarked for the development of education, health and cultural infrastructure. The Ministry of Education and Science has been allocated €11.9 million, including for the digitization of Latvian language resources and the provision of a modern learning environment. Investments in the health sector are directed towards the modernization of hospital infrastructure and the improvement of the e-health system, while the Ministry of Culture's investments of €5.7 million will be used to preserve cultural heritage, strengthen digital security, and modernize museum exhibitions.

Digitalization and climate policy projects also play a significant role in the investment structure. The Ministries of Finance, Climate and Energy, and Agriculture are continuing to develop information systems and data infrastructure, which improves administrative efficiency and cybersecurity, as well as promoting energy efficiency and environmental quality. These investments strengthen the country's resilience to crises and lay the foundation for sustainable economic growth in all regions.

Cooperation with partners and local governments

To strengthen social dialogue, the government actively cooperated with social and cooperation partners, as well as with local governments. This dialogue has resulted in a number of agreements and significant improvements in the financial stability and development of local governments. Next year, EUR 3 million will be allocated to five border municipalities – Ludza, Krāslava, Balvi, Alūksne and Augšdaugava – to strengthen security at the EU's external border. Local governments will also have greater opportunities to obtain loans for investment projects, particularly in areas related to security, education, and demographics.

Local governments are projected to see stable growth in tax revenues in the coming years – in 2026, together with compensation, the increase will amount to EUR 151.4 million, or 6.1%. The personal income tax forecast is also guaranteed in full, while revenues exceeding the guaranteed level will be redirected to repaying loans, strengthening the financial sustainability of local governments and supporting balanced regional development.

The government is paying particular attention to streamlining public sector spending by reducing bureaucracy, eliminating overlapping functions and ensuring regionally balanced access to resources. Measures to improve the efficiency of the public sector include reducing administrative expenditure and the number of posts in the State Revenue Service, reorganizing the Lotteries and Gambling Supervision Inspection, as well as reviewing funding for completed infrastructure projects, including the construction of the Liepaja prison, and other measures aimed at more efficient use of public funds.

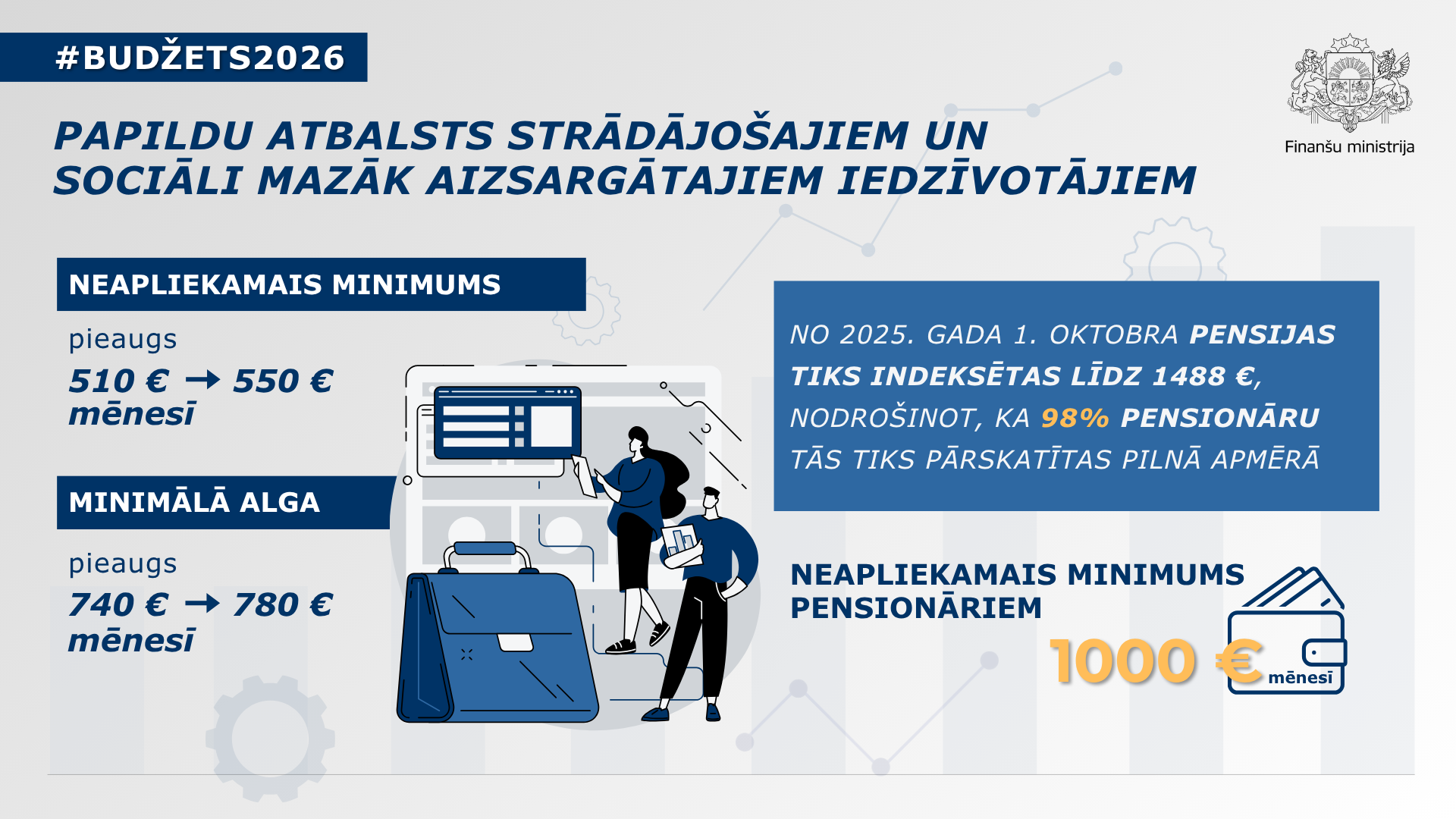

The government also remains committed to not raising basic taxes, making only changes that serve the public interest. Special measures are planned to support residents, such as reducing the value-added tax rate on essential food products and increasing the excise tax rate on harmful goods in order to promote public health and reduce inequality.

In 2026, there are also plans to increase both the minimum wage and the non-taxable minimum by €40, reaching €780 and €550 per month, respectively. Similarly, from October 1, 2025, pensions will be indexed to €1,488 (for comparison, in 2024 they were indexed to €683), ensuring that 98% of pensioners' pensions will be revised in full.

The package of draft laws accompanying the 2026 state budget is expected to include nearly 50 draft laws. The package of draft laws for the 2026 budget is scheduled to be submitted to the Saeima on Wednesday, October 15.