|

|

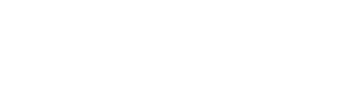

2020 |

2021 |

2022 |

2023 |

|

Minimum wage, EUR per month |

430 |

500 |

||

|

Compulsory social security contribution rate, including: |

35.09% |

34.09% |

||

|

24.09% |

23.59% |

||

|

11% |

10.5% |

||

|

Solidarity tax rate |

25.5% |

25% |

||

|

Personal income tax rate: |

|

|

||

|

20% |

20% |

||

|

23% |

23% |

||

|

31,4% |

31% |

||

|

Non-taxable minimum, EUR per month |

300 |

300 |

||

|

500 |

500 |

||

|

1 200 |

1 800 |

||

|

Allowance for dependants |

250 |

250 |

||

|

PIT distribution in local government budget / state basic budget |

80/20% |

75/25% |

||

|

Non-taxable minimum for pensioners, EUR per month |

300 |

330 |

||

|

Restriction of the micro-enterprise tax regime: |

|

|

||

|

40 000 |

25 000 |

||

|

15% |

25% |

||

|

20% |

40% |

||

|

5 |

1 (micro-enterprise owner)[1] |

||

[1] A transitional period until 30 June 2021 shall be determined for already adopted employees of micro-enterprises, during which the current regulation of the Micro-enterprise Tax Law will be applied until 31 December 2020. From 1 July 2021 all employees of the micro-enterprise (except the sole owner) will have to pay labour taxes in accordance with the general procedures in accordance with the Law On Personal Income Tax and the Law On State Social Insurance.

From 1 January 2021:

- reduced PIT progressive top rate from 31.4% to 31%, keeping other PIT rates unchanged (20% and 23%);

- the patent fee payment regime has been abolished, while maintaining the reduced licence fee payment regime for pensioners and persons with group 1 and 2 disabilities. Patent payers who have made the licence fee payment for 2021 until 31 December 2020 will be able to apply the licence fee regime also in 2021 for the period for which the licence fee was made;

- procedure for automatic repayment of PIT overpayments, as well as preconditions[1] for automatic repayment of PIT overpayments. The automatic repayment of the overpayment of PIT is planned to be introduced starting from 2023 for the PIT withheld in 2022;

- there is a regulation that provides that the State Revenue Service (SRS) may not repay the overpaid PIT if the SRS has information that the tax payer has not fulfilled its obligation – has submitted a mandatory annual income declaration for any of the previous taxation periods, if the payer would develop a PIT supplement during these periods. In such cases, the SRS will calculate the PIT for the tax payer according to the information in the SRS information systems and accordingly will be able to direct the overpayment of PIT for the settlement of PIT liabilities of the previous taxation periods;

- the procedures for the administration of eligible expenditure have been improved by providing that the SRS uses information of medical treatment and education service providers regarding the expenses of the tax payer in the processing of declarations, if the taxpayer has given consent to the service provider for the transfer of personal data related thereof for the completion of the declaration. The taxpayer has the right, when submitting an application to the SRS regarding deletion of specific data, to withdraw his or her consent by deleting the information received from the service providers in the SRS regarding payments which the taxpayer has the right to include in the declaration as eligible expenditure;

- expenses of an employee related to the performance of remote work which are covered by the employer in accordance with the Labour Law shall be exempted from PIT, if their total amount per month for full-time work does not exceed EUR 30 and the

[1] The State Revenue Service (SRS) will automatically refund the overpayment of PIT to taxpayers who have not submitted an annual income declaration, if certain conditions are met:

- the taxpayer has not registered economic activity, has not obtained income abroad, as well as has not obtained other income regarding which the information is to be included in the annual income declaration and the PIT shall be paid in accordance with summary procedures;

- the taxable person has no tax debts;

- automatic repayment of PIT overpayments can only take place if it results from the following factors:

- the annual differentiated non-taxable minimum;

- the non-taxable minimum of a pensioner, if the pensioner receives only a pension in accordance with the laws and regulations of Latvia;

- additional relief (for persons with disabilities, politically repressed and members of the national resistance movement);

- progressive PIT rates;

- in certain cases, under-use of the allowance for dependants;

- regarding the eligible expenditure of the taxpayer himself or herself, which are related to the contributions made by the person to private pension funds established in accordance with the law On Private Pension Funds and insurance premium payments made in accordance with the life insurance contract (with accumulation of funds) to an insurance undertaking which operates in accordance with the Law on Insurance Companies and their supervision;

- The SRS has information about the current account in Latvia to which the overpayment of PIT is to be repaid.

- relevant conditions are fulfilled[2]. This PIT exemption may not be applied during long absences exceeding 30 days;

- the inherited state funded pension capital income is equated with another type of pension income, thus the State funded pension capital, which is inherited in the event of the death of a member of the State funded pension scheme and which will be disbursed to the heir to a payment account with a credit institution, will be subject to PIT;

- a change in the regulation of PIT taxable income resulting from reduced or extinguished liabilities and PIT exempted reduced or extinguished liabilities;

- the benefit for the birth of three or more children in the same childbirth is PIT exempted;

- the notification way of the SRS decisions regarding registration of scholarship regulations and repayment of overpayment of PIT has been changed;

- the eligible expenditure of the taxable person may include medical and educational expenses for a sibling who has a group 1 or 2 disability;

- the registration certificate of the performer of economic activity is replaced by an entry in a publicly accessible part of the register;

- changes in advance payment deadlines for solidarity taxpayers;

- the range of payers who may submit declarations until 1 July of the post-taxation year has been specified for ensuring uniform application of the Law;

- the rules relating to changes in laws and regulations establishing administrative liability have been clarified;

- the form of the statement of income paid to a natural person has been changed;

- amendments have been made in relation to the changes to the Micro-enterprise Tax Law;

- for persons who receive a pension in accordance with the Law On State Pensions, the non-taxable minimum is increased to EUR 3 960 per year (EUR 330 per month);

- the amount of income taxable with PIT above which the annual differentiated non-taxable minimum is not applied is increased up to EUR 1800 per month, which means that real income will increase for people with low and medium-sized incomes. Also, the forecasted income growth coefficient (K2) of the monthly non-taxable minimum calculation formula will change from 1.09 to 1.06, which is applied by the SRS.

From 1 July 2021 changes in royalty income shall come into force. Changes in royalty income from 1 July 2021 to 31 December 2021:

- if the royalties are disbursed by an income disburser who is a collective management organisation (e.g. AKKA/LAA), then the income disburser will withhold PIT in the amount of 20% during the taxation year, applying a notional expenditure norm of 25% or 50% (depending on the type of work of the author or performer) of the revenue. If the total income during the taxation year exceeds EUR 20 004, the progressive PIT rate (for income from EUR 20 004 to EUR 62 800 - 23%, but for the part of income exceeding EUR 62 800 - 31%) will be applied, which is calculated in accordance with summary procedures by submitting an annual income declaration;

- if the royalties will be disbursed by another income disburser other than the collective management organisation, from 1 July 2021 there will be a gradual transition (if the natural person is not registered in the SRS as a performer of economic activity) and the recipients of royalties will commence the tax payments as registered performers of economic activity:

- if a natural person has not registered as a performer of economic activity, from 1 July 2021 to 31 December 2021 the special regime of the PIT transitional period will be applied - from the annual income up to EUR 25 000 the income disburser withholds tax in the amount of 25%, from income exceeding EUR 25 000 - in the amount of 40%. In this case, the tax withheld by the payer of the royalties is divided into: 80% compulsory state social security contributions and 20% PIT;

- if a natural person registers economic activity, he or she will be able to choose to pay PIT under the general regime or register as a micro-enterprise taxpayer;

- if the person has registered economic activity in the general regime as the payer of PIT, he or she will pay the PIT in accordance with the general procedure, applying progressive PIT rates: for annual income up to EUR 20 004 – 20%, for annual income from EUR 20 004 to EUR 62 800 – 23%, for the part of income exceeding EUR 62 800 – 31%. In this case, the recipient of royalties will be entitled to deduct from the payment the notional expense norm in the amount of 25% or 50% (depending on the author's work or type of performer) from the revenue. If the actual expenditure of the author is higher, it will be possible to include actual expenditure in the expenditure for economic activity in accordance with the procedures laid down in the Law On Personal Income Tax, if they are based on corroborative documents (in this case the recipient of royalties will not be entitled to apply the conditional expenditure norm);

- if the person has registered as a micro-enterprise taxpayer, then the person will pay the micro-enterprise tax for the royalty income, applying a rate of 25% to turnover up to EUR 25 000 per year, and a rate of 40% to the part of turnover exceeding EUR 25 000 per year. The recipient of royalties will not be entitled to deduct the notional expense norm in the amount of 25% or 50%.

If the royalty contract has been concluded until 31 December 2020 and the payment in conformity with the concluded royalty agreement is disbursed during the taxation year 2021, in the taxation year 2021 for the income from the above-mentioned royalty contract the norms of the Law On Personal Income Tax, which were in force on 31 December 2020 will be applied.

[2]

1) the agreement on the performance of remote work is specified in the employment contract or with the order of the employer and it is indicated what expenses are compensated by the employer;

2) the expenses related to the performance of remote work are covered by the employer to whom the salary tax booklet of the employee has been submitted;

3) the amount of expenses related to the performance of remote work shall be determined in proportion to the load and the number of remote working days per month indicated in the contract or order, if the work is performed both remotely and at the workplace.