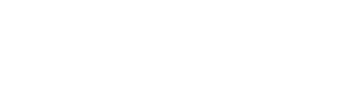

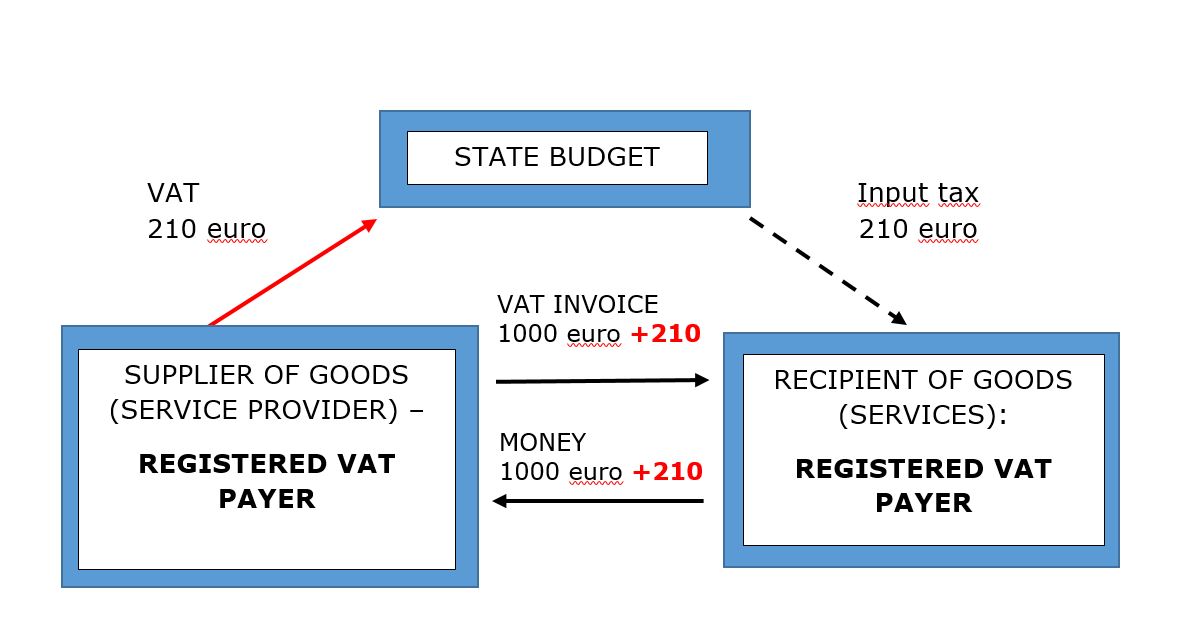

The reverse charge mechanism is applied to supplies of goods or services specified in Articles 141, 142, 143, 1431, 1432, 1433 and 1434 of the Value Added Tax Law, when the supplier of goods or services and the recipient of goods or services are registered taxpayers and the transaction is carried out within the territory of Latvia (inland).

Reverse charge mechanism

1. The supplier of goods or services:

- issues a VAT invoice to the recipient of goods or services indicating the value of the supplied goods or services of EUR 1000 excluding VAT and including a reference to the Section of the Value Added Tax Law, if any of the special taxation arrangements referred to in Section 141, 142, 143, 143.1, 143.2, 143.3, or 143.4 of the Value Added Tax Law is applied to the supply of goods or services, or to the relevant Article of Council Directive 2006/112/EC of 28 November 2006 on the common system of VAT;

- includes a transaction value of EUR 1000 in VAT return.

2. The recipient of goods or services:

- pays the VAT invoice value of EUR 1000 to the supplier of goods or services;

- calculates VAT amount of EUR 210 on the transaction value indicated on the VAT invoice, applying the appropriate VAT rate (i.e., EUR 1000 x 21%);

- includes the calculated VAT amount of EUR 210 in VAT return as VAT payable to the State budget;

- if the received goods or services are intended for the provision of transactions subject to VAT of the recipient of goods or services, the calculated VAT amount of EUR 210 shall be included in VAT return as deductible input tax.

Reverse charge VAT procedures shall apply to the following transactions:

- for the supply of timber and related services (Section 141 of the Value Added Tax Law) - from 1 July 1999;

- for the supply of scrap metal and related services (Section 143 of the Value Added Tax Law) - from 1 October 2011;

- construction services (Section 142 of the Value Added Tax Law) – from 1 January 2012;

- for the supply of mobile phones, tablets, laptops and integrated circuit devices (Section 143.1 of the Value Added Tax Law) – from 1 April 2016;

- supplies of cereals and technical crops (Section 143.2 of the Value Added Tax Law) - from 1 July 2016;

- for supplies of untreated precious metals, precious metal alloys and metal clad with precious metals (Section 143.3 of the Value Added Tax Law) - from 1 January 2017;

- for supplies of game consoles (Section 143.1 of the Value Added Tax Law) – from 1 January 2018;

- for supplies of ferrous and non-ferrous semi-finished metals (Section 143.4 of the Value Added Tax Law) - from 1 July 2019;

- for the supply of metal products and related services (Section 143.4 of the Value Added Tax Law) - from 1 January 2018 to 30 June 2019;

- for the supply of construction products (Section 142 of the Value Added Tax Law) - from 1 January 2018 to 31 December 2019;

- for the supply of household electronic equipment and household electrical appliances (Section 143.5 of the Value Added Tax Law) - from 1 January 2018 to 31 December 2019.